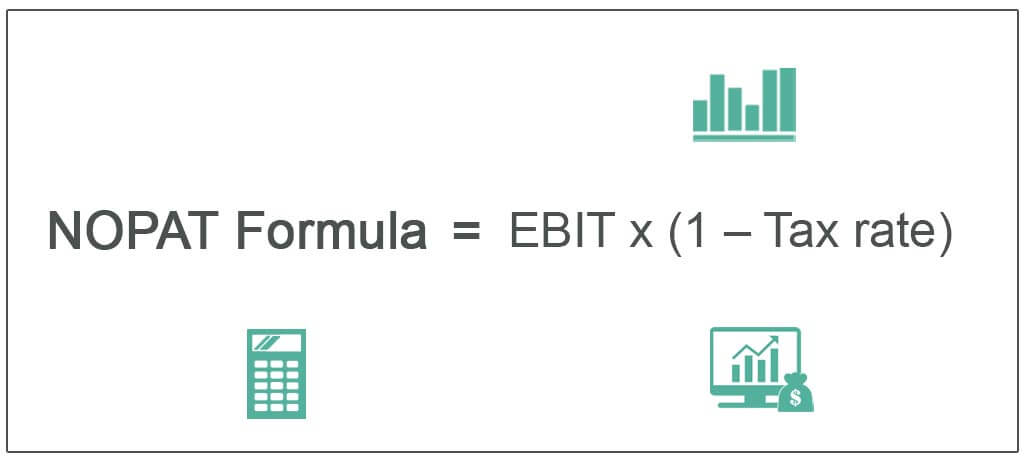

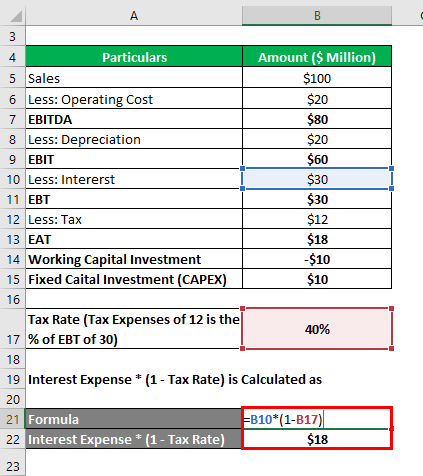

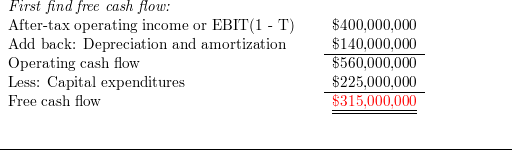

InvertirDesdeCero on Twitter: "(13/n) Para calcularlo lo hago de la siguiente manera: ROIC = EBIT x (1-Taxes) / Capital Invertido Ajustamos el EBIT por impuestos en el numerador El Capital Invertido sería

to 5 are graphical presentations of the discussed relationships and... | Download Scientific Diagram

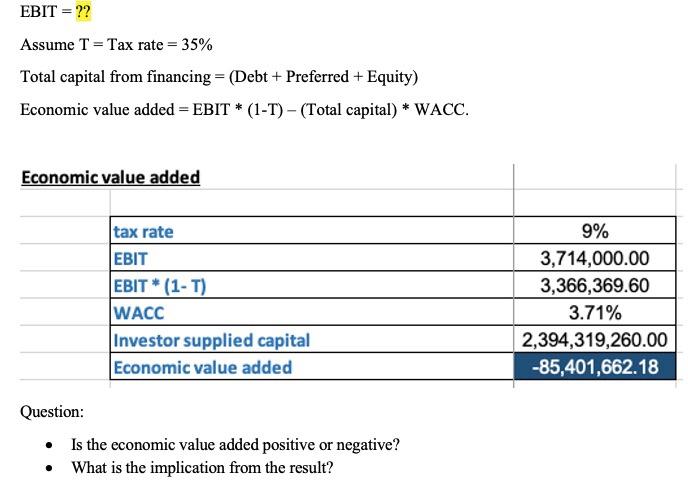

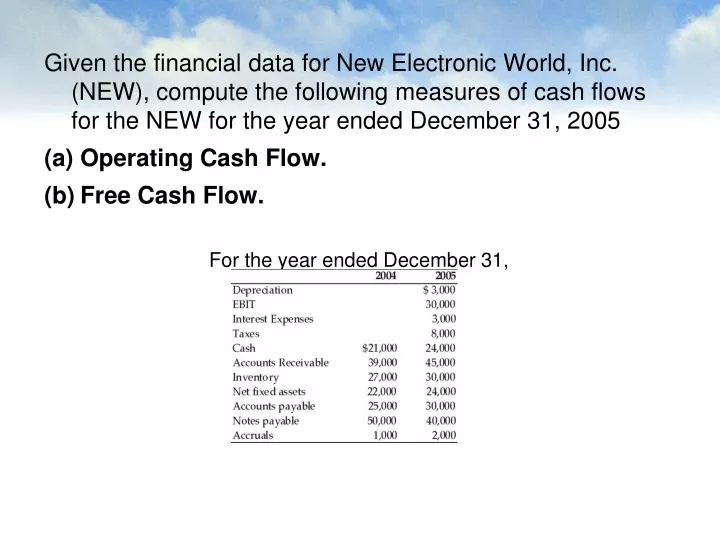

![Venture Capital and the Finance of Innovation [Course number] Professor [Name ] [School Name] Chapter 11 DCF Analysis of Growth Companies. - ppt download Venture Capital and the Finance of Innovation [Course number] Professor [Name ] [School Name] Chapter 11 DCF Analysis of Growth Companies. - ppt download](https://images.slideplayer.com/26/8648979/slides/slide_6.jpg)

Venture Capital and the Finance of Innovation [Course number] Professor [Name ] [School Name] Chapter 11 DCF Analysis of Growth Companies. - ppt download

To calculate Return on Total Assets Ratio, we may either use Net Profits after Tax + Interest or EBIT(1-t) in - Accountancy - Accounting Ratios - 13065121 | Meritnation.com

:max_bytes(150000):strip_icc()/Earnings-Before-Interest-and-Taxes-97b90834ddfe45e985e5e931a4b860e1.png)